Missed your MGT-14 filing? You could face a ₹10,000 penalty, increasing daily. Smart businesses file MGT-14 on time to avoid fines, maintain transparency, and stay fully compliant with the Companies Act, 2013.

What is MGT-14?

Form MGT-14 is a statutory e-form that companies must file with the Registrar of Companies (ROC) to report certain resolutions passed during board or general meetings.

It is governed by Section 117 of the Companies Act, 2013, and ensures accountability and proper governance.

Purpose of Form MGT-14

Companies use MGT-14 to:

- Notify ROC about special resolutions.

- Report specific board decisions as per law.

- Document structural changes (MOA/AOA, capital, etc.).

- Comply with legal requirements of the Companies Act.

- Maintain public records for stakeholder transparency.

Legal Provisions Governing MGT-14

| Provision | Description |

|---|---|

| Section 117 | Mandates filing of specified resolutions and agreements with ROC. |

| Section 179(3) | Lists key board powers requiring resolutions to be filed (e.g. borrowing, investment). |

| Rule 24 of Companies (Management and Administration) Rules, 2014 | Requires filing of MGT-14 within 30 days of resolution with supporting documents. |

Types of Resolutions Requiring MGT-14

1. Ordinary Resolutions

Used for routine matters like:

- Appointment of auditors

- Approval of financial statements

- Declaration of dividends

Passed by: Simple majority (≥50%)

2. Special Resolutions

Required for decisions involving:

- Alteration of MOA or AOA

- Shifting registered office to another state

- Private placement or share buyback

- Reduction of share capital

Passed by: At least 75% approval from shareholders and board

3. Written Resolutions

- Used for urgent decisions without a physical meeting.

- Must be signed by all eligible members.

Annexures Required:

| Resolution Type | Required Annexure |

|---|---|

| Board Resolution | Annexure A |

| Special Resolution | Annexure B |

| Ordinary Resolution | Annexure C |

4. Board Resolutions Under Section 179(3)

Mainly applicable to public companies for:

- Borrowing limits

- Approving financials

- Issuing securities

- Granting loans/guarantees

- Mergers, acquisitions, diversification

5. Other Specified Resolutions

These may also require MGT-14 filing:

- Appointment or reappointment of Managing Director

- Employment terms for MD/CEO

- Agreements under specific sections of the Act

- Unanimous resolutions deemed special by law

Applicability of MGT-14 in 2025

Public Limited Companies

Required to file for:

- All special resolutions

- All board resolutions under Section 179(3)

Private Limited Companies

Required for:

- All special resolutions

- Certain board resolutions (unless exempted)

Exemption Conditions (As per MCA Notification G.S.R. 464(E)):

- Not a subsidiary of a public company

- No default in annual filings

- Fulfillment of MCA notification conditions

Note: Exemptions are subject to change. Always verify with the latest MCA circulars.

MGT-14 Due Date and Late Fee

| Event | Deadline |

|---|---|

| Resolution Passed | Day 0 |

| MGT-14 Filing Due | Within 30 days |

Late Filing Fees (as per Companies (Registration Offices & Fees) Rules, 2014):

| Delay Period | Additional Fee |

|---|---|

| Up to 15 days | 1× base fee |

| 16 to 30 days | 2× base fee |

| 31 to 60 days | 4× base fee |

| 61 to 90 days | 6× base fee |

| 91 to 180 days | 10× base fee |

| 181 to 270 days | 12× base fee |

MGT-14 Filing Fees Based on Authorized Share Capital

| Authorized Capital | Normal Fee (INR) |

|---|---|

| Less than ₹1,00,000 | ₹200 |

| ₹1,00,000 – ₹4,99,999 | ₹300 |

| ₹5,00,000 – ₹24,99,999 | ₹400 |

| ₹25,00,000 – ₹99,99,999 | ₹500 |

| ₹1 crore or more | ₹600 |

Penalty for Non-Compliance (Section 117(2))

| Defaulter | Penalty |

|---|---|

| Company | ₹10,000 + ₹100/day (Max ₹2 lakh) |

| Officer in Default | ₹10,000 + ₹100/day (Max ₹50,000) |

Penalty accrues starting from the 31st day after resolution.

Documents Required for MGT-14 Filing

| Document Type | Requirement |

|---|---|

| Certified copy of resolution | Mandatory |

| Explanatory statement (Sec 102) | Mandatory for special resolutions |

| Meeting notice & minutes | Mandatory |

| MOA/AOA copy (if amended) | If applicable |

| Agreement copies | If resolution involves contracts |

All documents must be submitted in PDF, self-attested, and digitally signed.

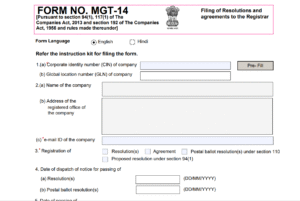

Information Required in MGT-14

- Corporate Identification Number (CIN)

- Company name, registered address, and contact

- Type and date of meeting

- Dispatch date of notice

- Quorum and chairman details

- Resolution number, type, text

- Voting results

- Linked form references and annexures

Step-by-Step Filing Process for MGT-14

Step 1: Download & Fill the Form

- Visit mca.gov.in

- Go to Company Forms > Download Forms

- Select MGT-14, fill all required details

Step 2: Attach Required Documents

- Upload signed, clear PDFs of certified resolutions and notices

- Verify file format and readability

Step 3: Apply Digital Signature (DSC)

- Use DSC of a director or company secretary

Step 4: Submit Form and Pay Fees

- File online via MCA portal

- Make payment through net banking or debit/credit card

- Save the Service Request Number (SRN)

What If MGT-14 is Not Filed Within 300 Days?

Filing is blocked after 300 days. You must:

- File Form CG-1 with Regional Director

- Explain the delay with supporting documents

- Pay condonation penalty as prescribed

- Receive condonation order

- File INC-28 with ROC

- File MGT-14, quoting INC-28 SRN

Common Filing Mistakes to Avoid

- Filing non-mandatory resolutions

- Incorrect or incomplete CIN, resolution dates

- Uploading unsigned or illegible documents

- Using expired DSC

- Missing pre-scrutiny check

- Confusing private company exemptions

FAQs on MGT-14 – People Also Ask

What is the due date to file MGT-14?

Form MGT-14 must be filed within 30 days from the resolution date.

Is MGT-14 mandatory for private companies?

Yes, for all special resolutions and select board resolutions (unless exempted by MCA).

What are the penalties for not filing MGT-14?

A penalty of ₹10,000 plus ₹100/day of delay applies. The cap is ₹2 lakh for companies and ₹50,000 for officers.

Can I file MGT-14 after 300 days?

No. You must first apply for condonation via CG-1, get RD approval, and then file INC-28, followed by MGT-14.

Where can I get the latest MGT-14 form?

Visit www.mca.gov.in > MCA Services > Company Forms > Download MGT-14.

MGT-14 Download Link

To download the latest MGT-14 form, visit:

https://www.mca.gov.in/ → MCA Services → Company Forms Download → Search “MGT-14”