Income Tax Exemptions and Deductions for Army Personnel (AY 2025–26)

Army personnel, like other salaried individuals, are subject to income tax under the Income Tax Act, 1961. However, in recognition of their unique service conditions, including postings in difficult terrains and high-risk zones, the government provides special tax exemptions and deductions.

These benefits are designed to reduce their tax burden and acknowledge the sacrifices made in the line of duty. In this guide, we explain the taxability of salary components, as well as key exemptions and deductions available to Army and Security Forces personnel for the Assessment Year 2025–26.

Fully Exempt Pay Allowances—AY 2025–26 for Army Personnel & security personnel

| Nature of Pay/Allowance | Exemption Status | Relevant Provision |

| Gallantry Award | Fully Exempt | A.O. 46/79; u/s 10(18)(i) IT Act (w.e.f. 1947) |

| Foreign Allowance | Fully Exempt | u/s 10(7) |

| Bhutan Compensatory Allowance | Fully Exempt | AO 395/74; u/s 10(7) |

| Servant Wages Allowance with BCA | Fully Exempt | AO 395/74; u/s 10(7) |

| Purchase of Crockery/Cutlery/Glassware | Fully Exempt | u/s 10(7) |

| Outfit Allowance on Embassy Posting | Fully Exempt | u/s 10(7) |

| Arrears of Cash Grant – Foreign Allowance (Nepal) | Fully Exempt | u/s 10(7) |

| Myanmar Allowance | Fully Exempt | u/s 10(7) |

| Representation Grant (for crockery set) | Fully Exempt | u/s 10(7) |

| Leave Encashment on Retirement (superannuation/voluntary/invalidment) | Fully Exempt | u/s 10(10AA)(i) (w.e.f. 01.04.1978) |

| Outfit Allowance (Initial/Renewal) | Fully Exempt | u/s 10(14)(i); Rule 2BB(1)(f) |

| Compensation for Change of Uniform | Fully Exempt | u/s 10(14)(i); Rule 2BB(1)(f) |

| Kit Maintenance Allowance | Fully Exempt | u/s 10(14)(i); Rule 2BB(1)(f) |

| Uniform Allowance (Military Nursing Services – MNS) | Fully Exempt | u/s 10(14)(i); Rule 2BB(1)(f) |

| Special Winter Uniform Allowance | Fully Exempt | u/s 10(14)(i); Rule 2BB(1)(f) |

| Any payment from Provident Fund | Fully Exempt | u/s 10(11) |

| Payment of Compensation – Disability Pension | Fully Exempt | CBDT Circular F.No. 200/51/99-ITA1 dated 02.07.2001 |

Partially Exempt Pay & Allowances for Army Personnel & security personnel

| Type of Allowance | Location / Criteria | Exemption Limit |

| Special Compensatory (Hilly Areas / High Altitude / Snow Bound / Avalanche) | Designated areas in Manipur, Arunachal, Sikkim, J&K, Himachal, etc. | ₹800 per month / ₹300 per month / ₹7,000 for Siachen |

| High Altitude Allowance | (a) 9,000 to 15,000 feet (b) Above 15,000 feet |

₹1,060 / ₹1,600 per month |

| Remote Locality / Border Area / Difficult Area / Disturbed Area Allowance | Andaman, Lakshadweep, NE states, HP, J&K, Uttarakhand, etc. | ₹200 – ₹1,300 per month |

| Installations in Continental Shelf / Exclusive Economic Zone of India | Offshore installations | ₹1,100 per month |

| Compensatory Field Area Allowance | Specific areas in Arunachal, Manipur, Sikkim, HP, UP, J&K | ₹2,600 per month |

| Compensatory Modified Field Area Allowance | Areas in Punjab, Rajasthan, HP, NE states, Sikkim, WB, J&K, etc. | ₹1,000 per month |

| Special Compensatory Highly Active Field Area Allowance | For Armed Forces across India | ₹4,200 per month |

| Counter-Insurgency Allowance | For Armed Forces in designated areas away from base | ₹3,900 per month |

| Island (Duty) Allowance | Andaman & Nicobar, Lakshadweep Islands | ₹3,250 per month |

| Children Education Allowance | Whole of India | ₹100 per child (max 2) per month |

| Hostel Expenditure Allowance | Whole of India | ₹300 per child (max 2) per month |

| Transport Allowance (Disabled employee) | For visually/hearing/orthopaedically handicapped | ₹3,200 per month |

| Underground Allowance | Employees working in mines | ₹800 per month |

| Transport System Allowance (Non-daily allowance recipients) | For employees in transport system | 70% of allowance up to ₹10,000/month |

Standard Deductions for Salaried Employees (Applicable to All)

| Deduction | Section | Limit |

| Standard Deduction | Sec 16(ia) | ₹50,000/₹75,000 |

| Professional Tax | Sec 16(iii) | As actually paid |

| Housing Loan Interest (Self-occupied) | Sec 24(b) | Up to ₹2,00,000 |

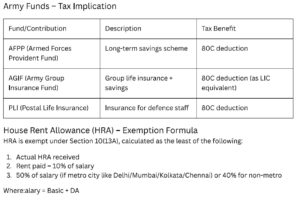

Deductions under Chapter VI-A (Investments & Payments)

| Section | Purpose | Maximum Deduction |

| 80C | LIC, PPF, NSC, ELSS, Tuition Fees, etc. | ₹1,50,000 |

| 80D | Medical insurance premium | ₹25,000 (₹50,000 for Sr. Citizens) |

| 80E | Interest on Education Loan | No upper limit |

| 80G | Donations | 50% or 100% (subject to conditions) |

| 80TTA/80TTB | Savings Interest (Non-Senior/Senior) | ₹10,000 / ₹50,000 |