Looking to download your PAN card digitally? This latest 2025 guide provides a step-wise walkthrough to download your e-PAN card through official government portals like NSDL, UTIITSL, and the Income Tax e-Filing portal.

What Is an e‑PAN Card?

An e‑PAN is a digitally signed PDF version of your PAN card. It carries the same legal status as a physical PAN card. With improved systems, users can now access PAN card free download options from official portals like NSDL, UTIITSL, and the Income Tax portal.

Eligibility for e‑PAN Card Download

Before you proceed with your PAN card download, ensure you meet the eligibility requirements:

- You must already have a valid PAN number.

- Your PAN application should be approved by the Income Tax Department.

- You should have access to your acknowledgment number (for NSDL/UTIITSL).

- For instant PAN via Aadhaar, your Aadhaar must be linked to a mobile number.

- You should have access to the registered mobile number or email used during PAN application.

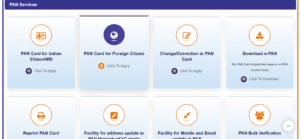

e‑PAN Card Download Options

The e‑PAN download process depends on where you originally applied. Choose one of the following portals:

- NSDL (Protean) Portal – For PAN cards applied through NSDL.

- UTIITSL Portal – For PAN cards issued by UTI.

- Income Tax e-Filing Portal – For instant e-PAN download using Aadhaar.

📝 Note: You must download your e‑PAN from the same portal where your application was submitted.

How to Download PAN Card Online in 2025

Here is the general process to download your e‑PAN card online:

- Visit the official portal where your PAN card was issued.

- Navigate to the e-PAN card download section.

- Enter required details – PAN number, acknowledgment number, or Aadhaar.

- Provide your date of birth and complete captcha.

- Choose OTP delivery (SMS or email).

- Enter the OTP received on your registered mobile/email.

- Click Download PAN Card Online to get your PDF.

- Use your DOB (DDMMYYYY) as the password to open the PDF.

NSDL PAN Card Download – Step-by-Step

To download your PAN card from the NSDL (Protean) portal:

- Visit www.protean-tinpan.com (official NSDL portal).

- Scroll to ‘PAN Services Links’.

- Select one of the following:

- e‑PAN (last 30 days) for recent applications.

- e‑PAN (older than 30 days) for earlier applications.

- Choose your search option:

- Use Acknowledgment Number if available.

- Use PAN if known.

- Enter:

- PAN or Acknowledgment Number

- Date of Birth (DD/MM/YYYY)

- Captcha

- Click Submit, choose OTP delivery method (email or mobile).

- Click Generate OTP, enter the OTP received.

- Click Validate, then Download PDF.

📌 Free download is available within 30 days. After that, a fee of ₹8.26 applies.

UTIITSL PAN Card Download – Step-by-Step

To download your e‑PAN from the UTIITSL portal:

- Visit pan.utiitsl.com.

- On the homepage, click on ‘Download e-PAN’.

- Click ‘Click to Download’.

- Enter:

- PAN (10-digit alphanumeric)

- Date of Birth (DD/MM/YYYY)

- GSTIN (if applicable)

- Captcha code

- Click Submit.

- Check your registered email for the download link.

- Click the email link to proceed.

- Enter the OTP sent to your registered mobile number.

- Download your e‑PAN card PDF.

💡 Just like NSDL, downloads are free for 30 days. After that, ₹8.26 is applicable.

Income Tax e-Filing Portal e‑PAN Download – Aadhaar Based

To instantly download your PAN using Aadhaar:

- Visit www.incometax.gov.in/iec/foportal/.

- Find ‘Quick Links’ and click ‘Instant e‑PAN’.

- Click ‘Continue’ under ‘Check Status/Download PAN’.

- Enter your 12-digit Aadhaar number, then click Continue.

- Enter the OTP received on your Aadhaar-linked mobile number.

- Tick the checkbox to agree to terms.

- Click ‘Continue’.

- Click the ‘Download e-PAN’ button.

✅ This service is completely free and gives instant access to your digital PAN.

How to Download e‑PAN Without PAN Number

If you don’t remember your PAN but have the acknowledgment number:

For NSDL:

- Visit onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html.

- Select ‘Acknowledgment Number’.

- Enter your 15-digit acknowledgment number.

- Provide DOB and complete captcha.

- Choose OTP method and complete verification.

- Click Download to complete the process.

For Income Tax (Aadhaar-based):

- Visit Income Tax e-Filing portal.

- Click ‘Continue’ under ‘Check Status/Download PAN’.

- Enter Aadhaar number instead of PAN.

- Verify using OTP and download the PDF.

How to Download e‑PAN With PAN Number

If you have your PAN number, use this method:

For NSDL:

- Go to NSDL portal.

- Select ‘PAN’ option.

- Enter:

- PAN number

- DOB

- (Optional) Aadhaar number

- Complete captcha and OTP verification.

- Click to download PAN card PDF.

For UTIITSL:

- Visit the UTIITSL portal.

- Enter:

- PAN number

- Date of birth

- GSTIN (if applicable)

- Complete captcha.

- Check email for link → verify with OTP → download PDF.

📌 First 30 days: free. Post that, ₹8.26 applies.

Download e‑PAN by Aadhaar Number (Instant e-PAN)

- Visit: eportal.incometax.gov.in/iec/foservices/#/pre-login/instant-e-pan

- Click ‘Continue’ under ‘Check/Download PAN’.

- Enter your 12-digit Aadhaar number.

- Click Submit.

- Enter OTP received on your Aadhaar-linked number.

- Agree to terms by checking the box.

- Click Submit to proceed.

- Click Download e-PAN.

This service is free 24/7 and gives immediate access to your PAN card.

Download e‑PAN with Acknowledgement Number

Mainly for NSDL applications:

- Go to NSDL portal.

- Select ‘Acknowledgement Number’.

- Enter your 15-digit acknowledgment number.

- Provide DOB in DD/MM/YYYY format.

- Enter captcha.

- Select your OTP delivery preference.

- Enter the OTP → Click Validate.

- Click Download PDF.

- Use DOB (DDMMYYYY) as password.

e‑PAN PDF Password Format

The PDF file is password-protected. Here’s how to open it:

- Password: Your date of birth in DDMMYYYY format

Examples:

| Date of Birth | Password |

|---|---|

| 15 March 1990 | 15031990 |

| 5 July 1985 | 05071985 |

For companies or firms, use the date of incorporation instead.

Final Thoughts

The e‑PAN download process in 2025 is quick, user-friendly, and secure. Whether through NSDL, UTIITSL, or Income Tax e-Filing, you can:

- Download your e-PAN instantly

- Avoid physical card delays

- Access official PAN card PDF securely

Always use official government portals to avoid phishing and fake services. With the PAN card free download feature and multiple download attempts, this process is efficient and budget-friendly.

Frequently Asked Questions (FAQs)

1. Can I download my e‑PAN from any portal?

No. Use the same portal where your PAN application was submitted.

2. Is there a fee for downloading e‑PAN?

Free for 30 days post-issue via NSDL/UTIITSL. Always free on Income Tax portal.

3. Can I download my e‑PAN without OTP?

No. OTP verification is mandatory on all portals for security reasons.

4. Is an e‑PAN legally valid?

Yes. It holds the same legal value as a physical PAN card.

5. What is the PDF password?

It’s your DOB in DDMMYYYY format. Use date of incorporation for firms.

6. Can I use mobile apps for e‑PAN?

Yes. MyPAN app (UTIITSL) and UMANG offer mobile downloads.

7. How fast is the instant e‑PAN?

Generated within 10 minutes via Aadhaar.

8. Are documents required for e‑PAN download?

No. You only need your PAN/Ack No., DOB, and access to OTP.

9. Can I download it multiple times?

Yes. Unlimited downloads on Income Tax portal. NSDL/UTIITSL: 3 free downloads within 30 days.

10. What if I face errors during download?

Ensure correct inputs. If issues persist, contact official support of NSDL, UTIITSL, or Income Tax.